Leverage Machine Learning based insights

for collections strategy, personalized engagements

and digital empowered operations.

India’s Best Selling AI-powered Loan Collections

Platform - three times winner* for 2022 -2024.

.avif)

Simplify your debt resolution and loan collection processes using cutting-edge AI technology, data-driven insights, and personalized strategies.

.avif)

.png)

.png)

.png)

An AI powered platform that helps Insurance companies in supercharging renewals, premium collections, upsell, and cross-sell with AI based payment-intent prediction, omnichannel communications, process automation, GenAI Voicebot and Videos, Dialer, WhatsApp ChatR, Document Management and end-to-end services.

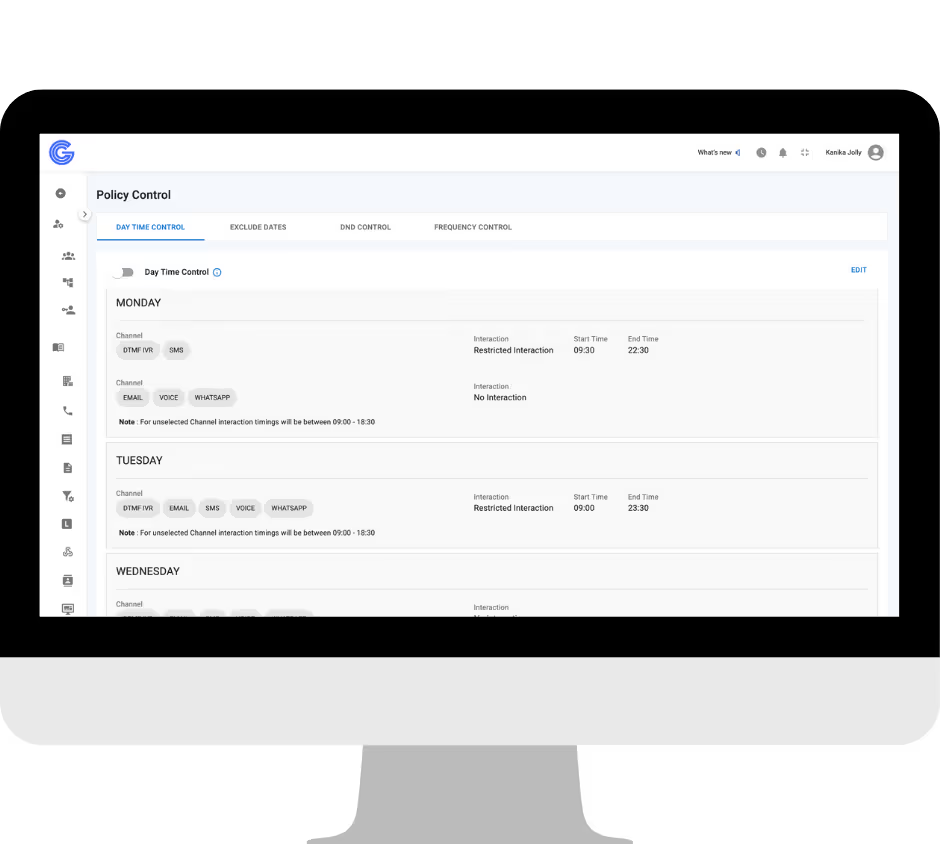

Credgenics collections platform ensures compliance with all the requisite regulatory requirements encompassing communications across digital channels, field and calling teams.

The platform provides a comprehensive policy framework for implementing DND, Frequency and Daytime Controls, and Date Exclusion.Credgenics masks the borrower-related personal information in accordance with data privacy laws.

Send automated emails, text messages and voice messages based on borrower segments.

Trigger communication sequences based on the actions your borrowers take, automatically. Reach your customers where they prefer.

Let the Credgenics AI use your past loans accounts data to calculate the recovery chances, costs and expected time for every profile.

Don't treat all borrowers the same. Let the system recommend best strategies for each account.

Don't let your customers feel harassed by too many phone calls. Auto-generate personalized payment requests that clients can self-service.

Let your field agents navigate to the borrowers’ locations easily using the Google maps integration on the Credgenics mobile app. Integrated in-app calling facility to reach out to borrowers quickly.

Enable field agents to collect better with the multilingual CG Collect app available in 22+ Indian languages along with Bahasa and Vietnamese.

Mark the status of repayment instantly, set collection limits per agent and auto sync with core Credgenics platform.

Access legal notices sent to borrowers on the go.

Track section 138, Arbitration and SARFAESI cases in real-time, know which stage each cases in and get reminders for your hearing dates.

Monitor the performance of various legal resources and the engaged advocates in terms of closure and recovery rates of cases.

Enable borrowers to pay their bills securely across multiple payment modes with mandatory OTP-based verification. Allow lenders to generate payment links instantly and reconcile transactions in real time.

Set-up recurring auto-debit through Billzy via the NACH mandate for monthly loan repayments on the due date. Integrate seamlessly with other loan recovery functions including Notices, Mobile Collections App, SMS, Email, WhatsApp and IVR.

.avif)

Bulk trigger dunning letters and legal notices customised for every loan account at the click of a button.

Get accurate and latest India Post tracking on our portal for all your LRNs and know if your clients received the notice

Know your best performing agents, your collection rate, your DPD-wise performance, total loan amounts recovered, most effective emails and more with detailed analytics.

Build custom reports and strengthen your collections processes.

Analyze borrower behavior to predict payment probability and risk of default for enabling tailored proactive actions. Prioritize collection accounts based on likelihood of repayment to speed-up collections and optimize resource allocation. Use data-driven insights to identify the best suited contact and collections strategy, personalize communications and maximize the outcomes. Enhance outreach effectiveness by optimizing timing, content, language, channels, and intensity. Use bounce prediction and recovery scores to optimize collections efforts.

.png)

Manage end-to-end retail collections and debt resolution processes

Accelerate debt recoveries through data, digital and dignity with Credgenics.

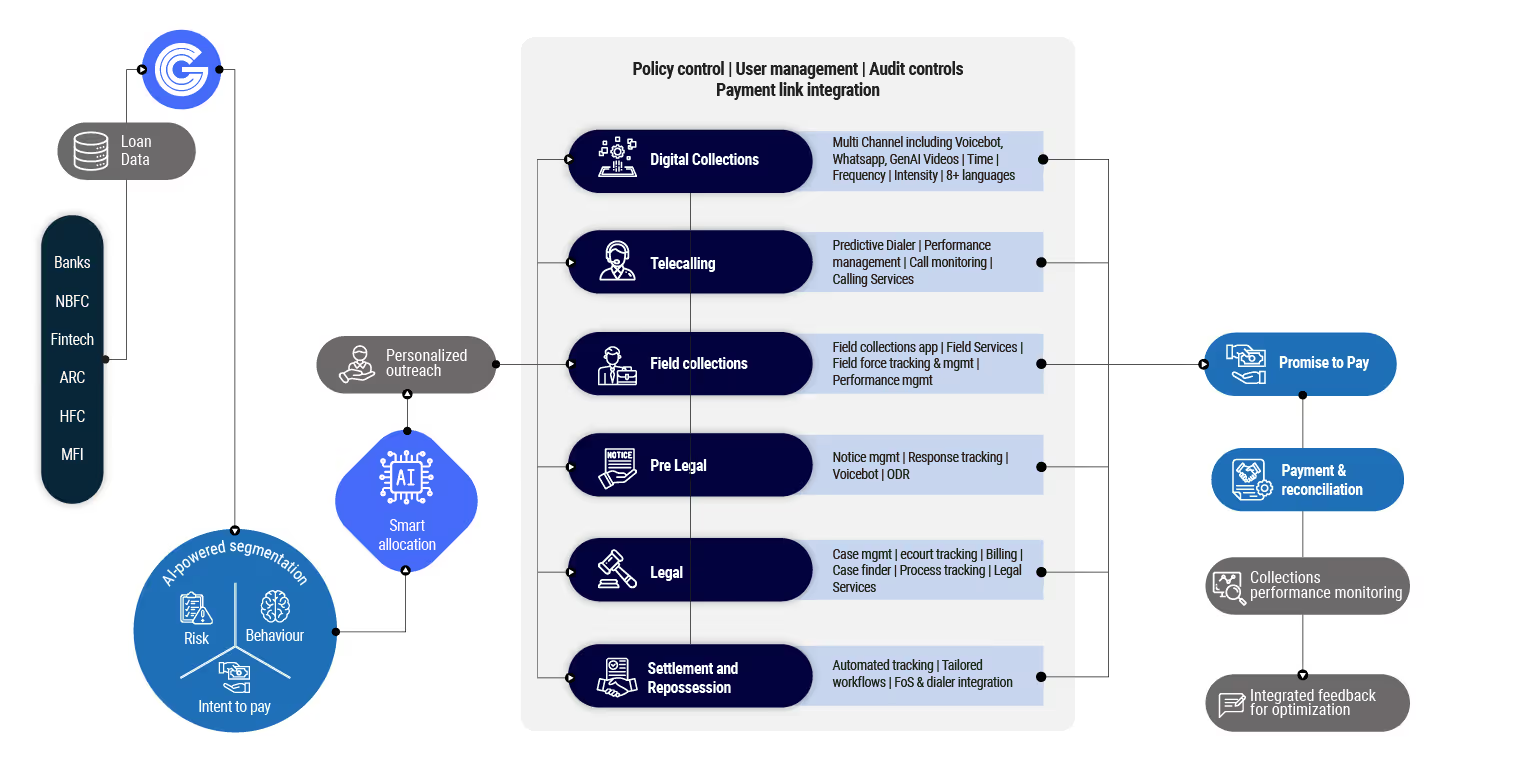

Credgenics is the debt collections market leader - redefining the landscape of loan recovery and debt collection. Our award-winning, AI-powered full-stack collections platform delivers:

1. AI and ML powered data analytics providing behavioral insights and payment trends for targeted, time-sensitive collections strategies

2. In-house technology stack for real-time visibility across all borrower touchpoints

3. Integrated collections journeys powered by GenAI capabilities for maximum efficiency

4. Robust policy controls for regulatory compliance

With comprehensive modules spanning digital communication, predictive dialer, notices, litigation management, field collections app, payments platform, and ODR (Online Dispute Resolution), we cover the entire loan collections lifecycle. The Credgenics collections software platform is purpose-built to serve a broad spectrum of users, including banks, NBFCs (Non-Banking Financial Companies), HFCs (Housing Finance Companies), MFIs (Microfinance Institutions), Fintechs, ARCs (Asset Reconstruction Companies), digital lenders, and dedicated collection agencies. With Credgenics, you're investing in a smarter, more efficient way to manage and recover debts.

An end-to-end collections platform like Credgenics transforms the debt recovery and loan collections process by providing a comprehensive solution that integrates collections journeys across digital, calling, field and legal.

From automated reminders and personalized borrower engagements to legal proceedings and payment collections, Credgenics simplifies complex processes and enhances operational efficiency.

By leveraging AI-powered analytics, predictive modeling, and digital communication tools, Credgenics enables lenders to identify high-risk accounts, prioritize collections efforts, and optimize communication strategies. Moreover, with a data-driven approach and intelligent automation, Credgenics empowers lenders to achieve faster, smarter, and more efficient debt resolution.

Credgenics drives superior debt collections and loan recovery rates through a strategic blend of AI-driven insights, predictive analytics, and personalized communication. Our platform uses advanced algorithms to segment borrowers, prioritize high-risk accounts, and tailor engagement strategies that maximize response rates.

We employ machine learning models to predict payment behavior, optimize communication channels, and schedule timely reminders, to ensure proactive and effective collections. Additionally, integrated litigation management platform streamlines pre-legal and legal proceedings, enhancing recovery outcomes. With Credgenics, lenders achieve higher recovery rates while maintaining positive customer relationships.

Credgenics Collections Software Platform is purpose-built to serve a broad spectrum of users, including banks, NBFCs (Non-Banking Financial Companies), HFCs (Housing Finance Companies), MFIs (Microfinance Institutions), Fintechs, ARCs (Asset Reconstruction Companies) and dedicated collection agencies. Our versatile platform caters to all businesses looking to enhance their debt recovery and loan collections strategies.

With solutions such as collections analytics, predictive dialer, digital communications, litigation management, ODR, Credgenics empowers collections teams to operate efficiently while maximizing recovery rates. From startups to established financial institutions, our solution ensures streamlined operations, compliance, and exceptional borrower experiences.

Credgenics prioritizes data security by implementing advanced encryption protocols, secure cloud storage, and role-based access controls. The platform ensures end-to-end encryption from data upload to processing, maintaining tokenization for enhanced data protection. Multi-user security and data backup mechanisms safeguard sensitive customer information throughout debt collections and loan recovery processes. Credgenics is ISO 27001 certified and follows industry best practices for data privacy, ensuring compliance with regulatory guidelines for financial institutions and borrowers.

Credgenics' AI / ML technology transforms debt collections by analyzing vast borrower data to develop precise collections strategies. Our algorithms predict payment behaviors, identify optimal communication channels and timing, and segment borrowers based on risk profiles for tailored approaches.

The platform continuously learns from interactions, improving predictions and refining strategies for better results. This intelligent automation reduces manual effort while enhancing decision-making through actionable insights, enabling collections teams to prioritize high-value accounts and personalize engagement strategies.

By leveraging predictive AI and machine learning, Credgenics enables lenders to anticipate defaults, implement preventative measures, and optimize resource allocation throughout the collections cycle—ultimately increasing recovery rates while maintaining positive borrower relationships and ensuring regulatory compliance.

Make the change for streamlined, higher collections. Get started now!